Between keeping up with Community Reinvestment Act (CRA) modernization efforts, the finalization of Section 1071 of the Dodd-Frank Act, and increased fair banking scrutiny, compliance officers have plenty on their plates. No matter what the outcome of the proposed CRA rules, it is clear that large banks (for CRA purposes) will experience the greatest degree of change. Small banks by comparison may see little impact. In any case, most banks will have at least one more CRA examination before the new finalized regulations are implemented, and it’s important to put the bank’s best face forward.

How Do You Prepare?

Start by reviewing the bank’s prior CRA performance evaluation (PE) to refresh your understanding of the activities that contributed to the bank’s performance rating. Why did the bank receive the rating it did? What are the bank’s strengths? Were there areas noted that suggest performance gaps? Having this knowledge will provide the perspective needed to focus your performance management strategy in preparation for the upcoming CRA exam. Once you identify these priorities, it is valuable to engage the bank’s board of directors and senior management in order to understand their rating expectations.

Regardless of prior exam-driven priorities, it is also useful to consider industry feedback, as it provides a “heads-up” regarding supervisory priorities, common issues, and best practices to mitigate potential exposures. The following three strategies will help your bank finish strong at your next examination:

Regardless of the outcome of CRA modernization, these three strategies will continue to be essential to CRA performance success. Let’s explore them further.

1. Maximize the Reporting of Community Development Activities

Oftentimes, large (for CRA purposes) banks overlook transactions, such as loans and investments, that could qualify for consideration as community development activities. This leaves the institution’s CRA rating at risk of being lower than it could be. Lending is the most heavily weighted aspect of a bank’s CRA performance, regardless of the bank’s size. Therefore, prioritizing the identification of community development loans can be a good place to start (especially for large banks). To represent the full extent of community development activities, banks should consider the following strategies:

- Maintain a strong CRA program. This starts with board and executive management buy-in and support from key internal stakeholders, such as loan officers. Commercial loan officers are key to identifying community development (CD) loans at origination, so be sure they are on board with understanding what the concept is all about.

- Promote buy-in. It is helpful to ensure lenders understand why their involvement matters by sharing with them the business reasons for identifying these loans. These include connecting how CD loans support a strong CRA rating, as well as enabling the bank’s capacity to grow through branching, mergers or acquisitions, which can be limited by a poor CRA rating. As lenders are the primary connection with customers, they are in the best position to provide the information needed to determine whether the loan qualifies for community development consideration. Make sure that lenders understand their significance in achieving the bank’s goals.

- Provide periodic training to lenders. This ensures they understand the four cornerstones of community development:

(1) Affordable housing;

(2) Community services;

(3) Economic development; and

(4) Revitalization/stabilization.

Further, many banks also embed “triggers,” in the form of questions or comment fields in loan proposal documents, as an effective internal control. These help lenders identify qualifying community development transactions. An example of such a question could be, “Is the business promoting economic development by creating, retaining, or improving jobs for low and moderate-income persons?” Incorporating community development considerations within loan origination workflow processes provide two key benefits. First, it provides a strong support of effective and efficient identification of CD loans. Second, involving loan officers and their operations teams during the loan process substantially reduces the laborious and expensive process of try to find qualifying loans right before the examination (aka “mining” for loans.)

- Revisit PPP loans. The pandemic has presented a special opportunity to revisit the bank’s SBA Paycheck Protection Program (PPP) loans, if it participated in the program, to identify qualifying community development loans.

The agencies issued Interagency Guidance to help banks identify PPP loans for either small business or community development consideration. (fdic.gov/coronavirus/smallbusiness/faq-sb.pdf). According to the guidance, many SBA PPP loans over $1 million may qualify as community development loans.

This is the case when an SBA PPP loan over $1 million—that was originated in a low- or moderate-income geography, or in a distressed or underserved nonmetropolitan middle-income geography—had an express purpose of economic development by helping small businesses retain jobs and support the revitalization and stabilization of these designated communities.

Many banks worked around the clock to provide PPP loans during the pandemic. As 2020 and 2021 will be included within the scope of upcoming examinations, there is an opportunity to identify qualifying loans. Moreover, the PPP can be considered an innovative and flexible lending practice.

- Maximize Community Development Investments. A critical step in maximizing a large bank’s CRA performance is to maximize its investments. Through the normal course of business, banks routinely make investments that may also meet the qualifying criteria for community development.

Common community development investments include such instruments as municipal bonds, mortgage-backed securities, low-income housing tax credits (LIHTC), New Markets Tax Credits, Opportunity Zone investments, and others. The OCC’s Community Development Fact Sheet on CRA: Community Development Loans, Investments, and Services is a useful quick reference for examples. (See occ.gov/publications-and-resources/publications/community-affairs/community-developments-fact-sheets/pub-fact-sheet-cra-comm-dev-loans-invest-svcs-jan-2019.pdf). These align with the Interagency CRA Questions & Answers (www.ffiec.gov/CRA/qnadoc.htm).

CRA professionals working with the bank’s treasury and investments functions to review investments for a community development purpose can help ensure all eligible CD investments are included for consideration. Just as with lenders, investment team members are significant as they are the best position to identify potential CRA-qualifying transactions. These functional areas are integral to an effective CRA program and will, like lenders, benefit from training. Moreover, embedding a periodic review of new investment activities enables the bank to identify missed investment opportunities well in advance of the next examination.

Quick Tip: CRA compliance professionals often find it efficient to review a list of securities by investment type to identify eligible obligations. To best understand the purpose of the investment, many CRA officers pull prospectuses to determine if an investment meets community development-qualifying activity. Common CRA-qualifying investments include:

- Municipal bonds placed to support a school primarily benefiting low- and moderate-income families. A common means to indicate whether the security primarily benefits the LMI area is to determine if the school participates in the federal government’s free and reduced lunch program (fns.usda.gov/nslp), and whether the percentage of the participating school’s student population exceeds 50 percent. This is typically considered a qualified community development investment with a primary purpose of extending community services to low- and moderate-income individuals.

- Mortgage-backed securities (MBS) are fixed-income investments, and are common within many large bank portfolios. Not all MBS investments qualify as community development investments, however. CRA officers typically review these securities to determine whether the underlying mortgages are:

This type of investment may also be considered a qualified community development investment, with a primary purpose of affordable housing for low- and moderate-income individuals.

In addition to contributing to the bank’s CRA investment performance, a bonus is that many of these instruments are high-quality investments proven to provide a market-rate return, with acceptable risk parameters that meet a bank’s credit quality underwriting standards as established by its asset-liability committee. Some individual investments may not provide market rate return, but when combined with other bank investments, may reach a blended rate of return that meets or exceeds return thresholds for similarly rated transactions with the added benefit of CRA qualification.

2. Conduct a Self-Assessment

Conducting a regular CRA self-assessment (SA) can be a powerful tool for maximizing the bank’s CRA rating. These assessments allow a bank to evaluate its performance between examinations to address weaknesses in a more timely manner, but also to “tell the bank’s story.” This involves describing developments affecting the community characteristics, posing market challenges, as well as the impact of the bank’s performance activities. The assessment can highlight key programs, retail distribution of products and services, and lending, service, and investment performance in the communities that the bank serves.

A self-assessment should mirror the core elements of the CRA performance evaluation prepared by examiners. Of course, at a minimum the SA should address areas identified as performance gaps. To assess performance, banks commonly compile and analyze data on a yearly basis, and compare it to benchmarks.

For example, to assess the sufficiency of small business lending in low and moderate-income (LMI) tracts, a bank would consider the percent of its LMI originations in its assessment area and compare it to the comparable percentage for the market aggregate (i.e., performance benchmark). (See www.ffiec.gov/craadweb/aggregate.aspx for small business data and for mortgage data see ffiec.cfpb.gov/data-publication/aggregate-reports.) In addition to a comparison to the market aggregate, if lending in LMI tracts was a noted weakness during the bank’s prior examination, the SA would note whether current performance showed progress or whether continued attention is warranted. Such a “mid-course correction” strategy may include efforts to increase lending organically through bank-originated loans including participation in special credit programs or similar initiatives, or through loan purchases.

In determining a “corrective” strategy, it is critical to work with functional areas or lines of business to implement performance solutions that are effective and sustainable. Strategies here include partnering with mission-driven entities such as Community Development Financial Institutions (CDFIs) and Minority Depository Institutions (MDIs).

3. Ensure CRA Data Integrity

The third key to finishing strong is to ensure the integrity of the bank’s loan data. An elevated focus here underscores the importance of data integrity regardless of whether a bank is a large institution subject to annual loan reporting requirements, or a small or intermediate-small bank that maintains its data and provides it only in response to CRA examination requests.

A few important issues include:

- Data validations for HMDA and/or CRA reporters are conducted in advance of scheduled fair lending and CRA examinations, as part of the examiners’ pre-exam process. This allows banks to resolve data errors so that examinations can proceed without delay.

- Resubmission of data may be required for CRA as well as HMDA data if error rates are excessive. Sampling and resubmission of CRA data is similar to HMDA sampling procedures, but CRA data contains different key fields (the loan amount at origination, the loan location—MSA, state, county, census tract—and an indicator whether the loan was to a business or farm with gross annual revenues of $1 million or less) and small business/small farm data must be verified for accuracy for reporters and non-reporters alike.

- Substandard data integrity may be noted as an overall compliance management system deficiency, and may trigger remediation requiring the bank to go back and “scrub” its data to ensure each core field is accurate. If a pattern of data errors is identified during the pre-examination process it is expected that the data will be corrected before the examination. This can be costly to execute whether the bank utilizes internal staff resources or a third party. Remediation can also delay the start of the CRA examination.

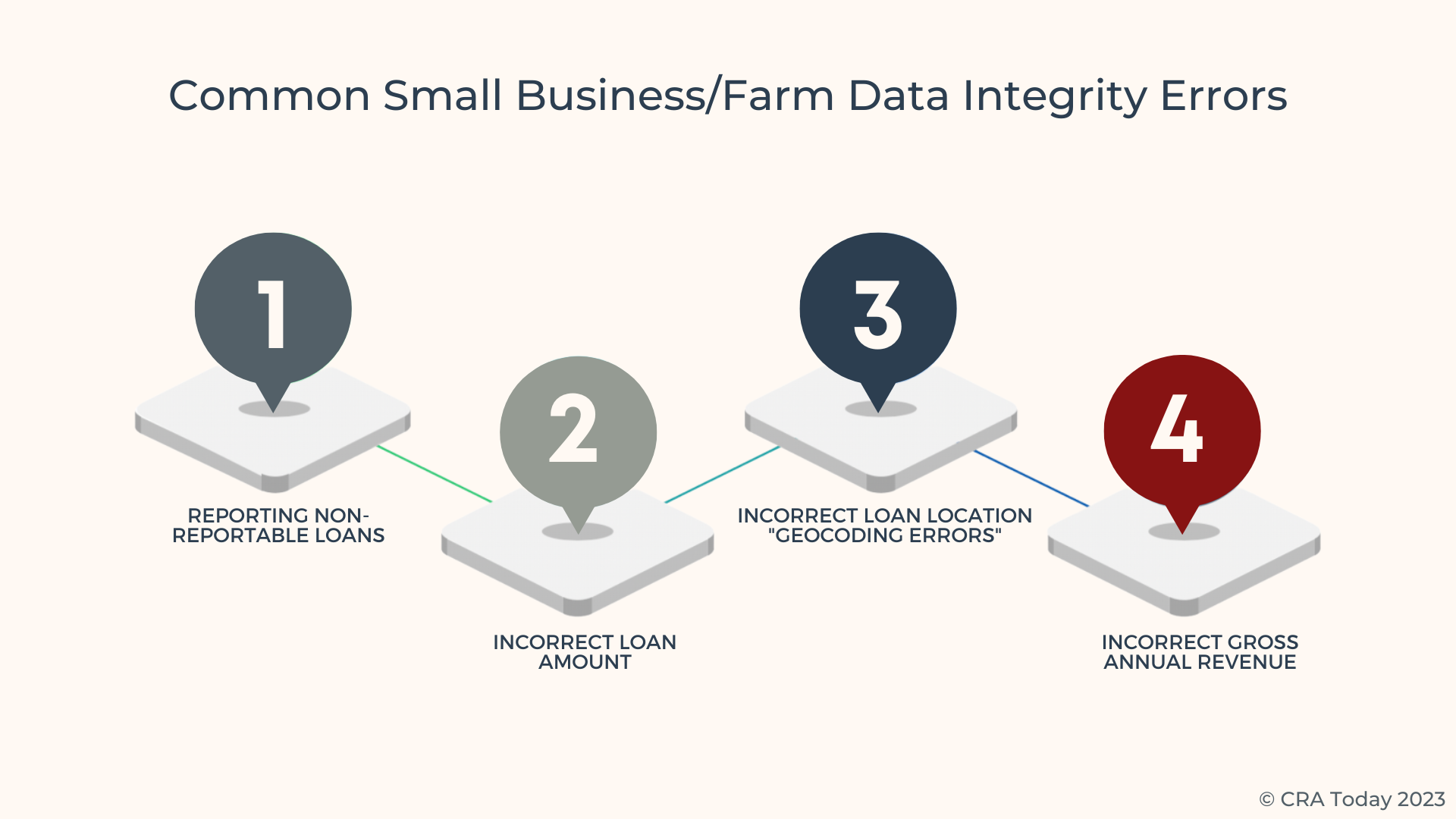

Common CRA Data Reporting Errors

Common CRA data errors include:

- Reporting non-reportable loans,

- Incorrect loan amount,

- Incorrect gross annual revenue, and

- Incorrect loan location (geocoding errors).

To minimize the risk of errors, key programming logic should be periodically reviewed, especially when extracting data from the bank’s core systems. Banks should also periodically review the data mapping used to import data into the bank’s CRA proprietary database. Include detailed descriptions of both the exporting and importing programming logic in the bank’s CRA data collection and reporting procedures. Evidencing the step-by-step data process flow will ensure that all key small business and small farm data elements move through all processes with integrity, including any manual (human) intervention that may exist.

Periodic audits of the bank’s data integrity should also be conducted. Compliance officers may embed qualify control data reviews within regular lending unit operations processes and then conduct sampled reviews to ensure data accuracy.

Understanding how data integrity reviews are conducted can be helpful. In fact, the agencies outline protocols and guidelines in their examination handbooks. For example, the FDIC’s Consumer Compliance Examination Manual (Section XI, CRA Timeframes and Sampling Guidelines) contains step-by-step procedures used to sample data. See fdic.gov/resources/supervision-and-examinations/consumer-compliance-examination-manual/index.html, and fdic.gov/resources/supervision-and-examinations/consumer-compliance-examination-manual/documents/11/xi-11-1.pdf.)

Examiners employ a statistical sampling model with five percent precision and a minimum ninety percent confidence interval. These procedures, as well as other guidance, such as error rate thresholds necessitating resubmission of the data, can be useful in planning internal integrity reviews.

In addition to reviewing and correcting data fields, the bank should prepare a root cause analysis for identified deficiencies. Compliance officers should brief executive management and involve the business units that originated the loan data. Depending on the scale and scope of the data issue(s), the bank may need to assemble a team, ad hoc committee, or focus group to isolate the root cause (human and/or system) and actively manage the remediation.

If data issues were identified during a previous CRA exam, be prepared to share with examiners the progress that the bank has made in addressing the problems. The bank may also want to share any other issues that it self-identified and resolved to demonstrate it has a strong CRA data integrity compliance program. Regulators prefer that banks self-identify data issues rather than have examiners find them. Sharing the data integrity approach and rigor instills confidence in the bank’s CRA and compliance programs.

A Final Word: Stay Focused on Fair Lending

It is critically important that CRA officers be involved in the bank’s fair banking efforts, given that these programs are intertwined. Don’t risk having the bank’s hard-fought CRA rating be downgraded by a fair lending violation.

The “art of CRA” is narrating the story of the needs of the community and the bank’s impact within them. Involving the lines of business in maximizing the bank’s performance is imperative. Once you document all the bank’s activities and know where its performance stands, you’ll want to make sure a data integrity issue doesn’t stop the examiners from moving into the full scope exam to recognize all the bank’s hard work and performance. As Benjamin Franklin said, “an ounce of prevention is worth a pound of cure.”

Ready for more?

Click here to join your peers in the CRA Hub!

- Driving Impact and Building Trust: The Power of Collaboration Between Compliance Professionals and Lenders in Community Development Lending - August 1, 2023

- Finish Strong, as published in ABA Bank Compliance - December 31, 2022

- What’s a Capital Stack and How Does it Work? - November 18, 2021