After the Final Rule was released in October 2023, we all seem to find ourselves asking this same question, what now?

Navigating the new rule while finishing strong with the current rule can seem daunting. This guide will help CRA Professionals as well as Chief Risk Officers in formulating a plan for regulatory change and provide the key risks to consider with questions to discuss with your team.

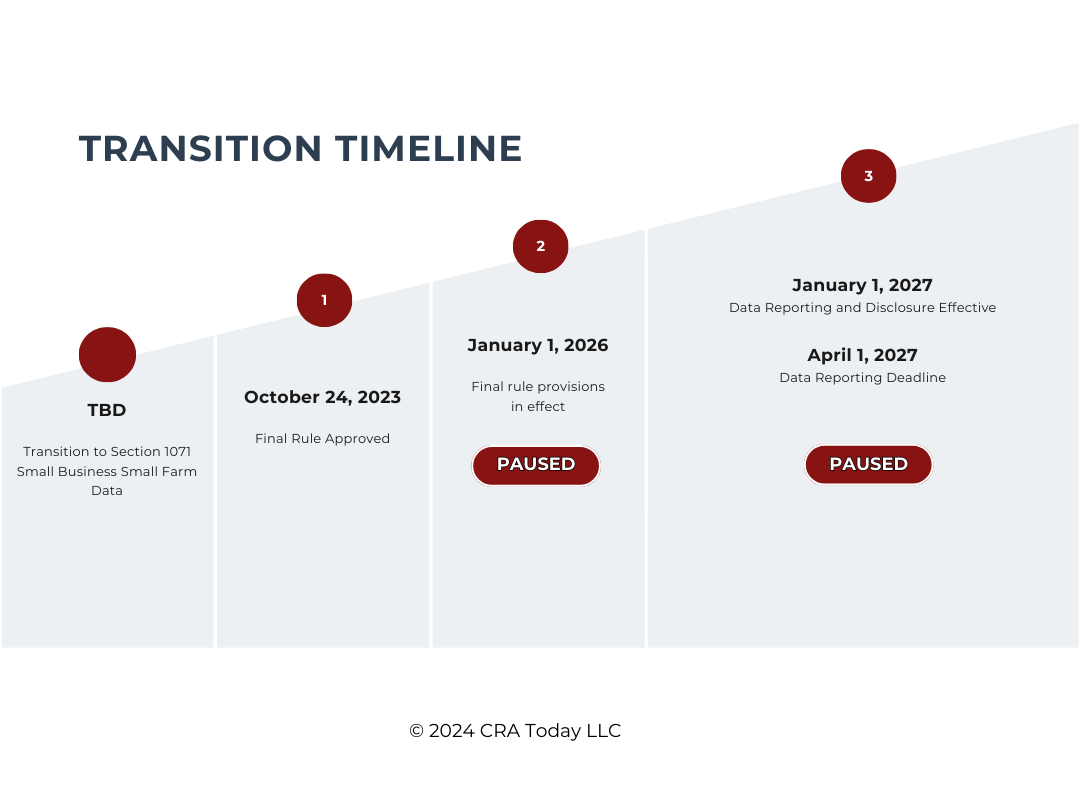

3.30.24: Federal Court Pauses CRA Rule Implementation Following ABA Lawsuit

3.21.24: Agencies Extend Applicability Date of Certain Provisions

of Their Community Reinvestment Act Final Rule

4 Steps to Navigating Regulatory Change

Step #1: Read the Rule

On October 24th, 2023, the Board of Governors of the Federal Reserve System (Board), the Federal Deposit Insurance Corporation (FDIC), and the Office of the Comptroller of the Currency (OCC) jointly issued a final rule amending the Community Reinvestment Act (CRA). Regulators continue to enhance their focus on oversight, supervision, and enforcement and CRA is no exception. Increased scrutiny is expected in the coming years.

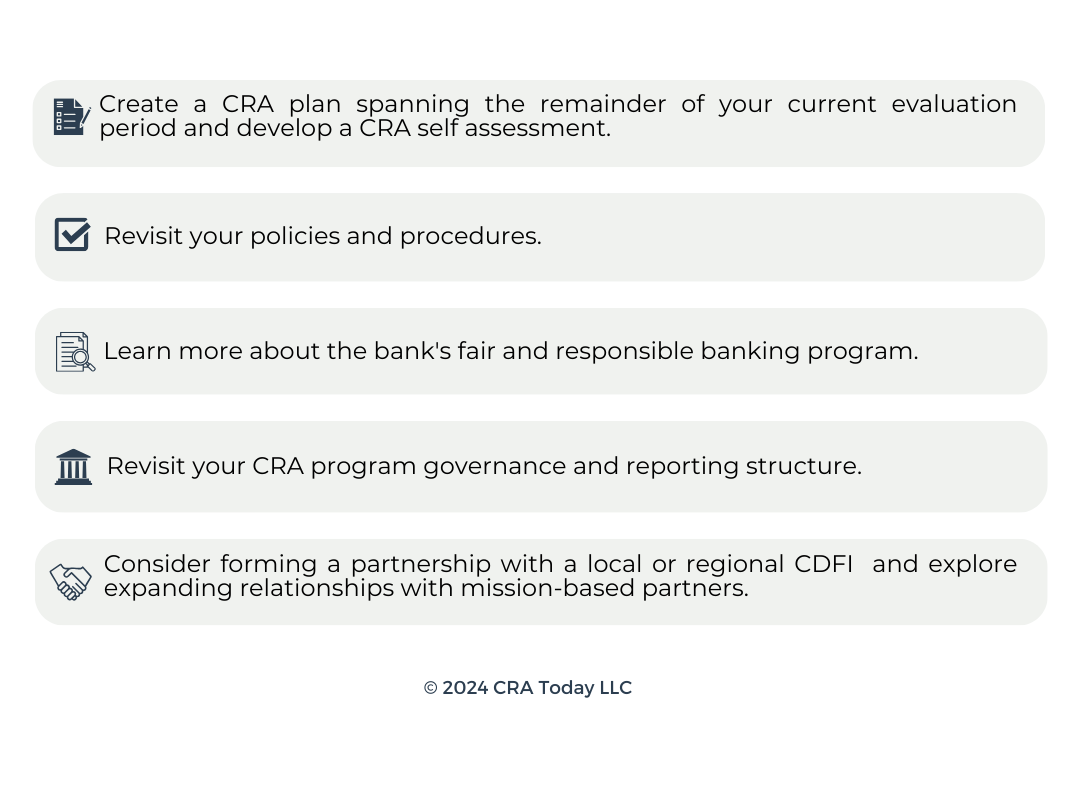

Step #2: Finish Strong with the Current Rule

With at least one more examination left under the current rules, it is important to take time to strengthen your bank’s current CRA program before approaching the new rule. Here are some steps to focus on to solidify your program now.

Step #3: Brief Your Executives and Have Strategic Conversations

Brief your executive management and have strategic discussions with key stakeholders to address the key risks associated with CRA modernization.

Step #4: Join the CRA Hub

The CRA Hub is a membership designed to offer structured guidance around running CRA programs. CRA Hub creates clarity around the technical aspects of the CRA, and builds a community of community development professionals across the nation.

In the Hub we will help you navigate regulatory change and implement the final CRA rule.