CRA Training, Advisory Services and Certification Program

CRA Today offers a wide variety of training and advisory services to help you master the CRA.

Whether you are new(er) to the CRA or a seasoned professional, we stand ready to get your exam ready and help you drive impact into your local communities.

Most start here!

The CRA Fundamentals course is a 10-week training program with live online training facilitated by Linda. This course is offered a few times a year and gives you a solid CRA foundation for growth. This course is the perfect place to start your CRA journey.

Then implement here!

The CRA Hub offers access to our library of advanced training, monthly live training sessions, peer collaboration, guest speakers, and a private community for CRA professionals.

This is where our seasoned CRA Officers hone their skills and level up their CRA programs for “Outstanding” impact.

Then advance and customize CRA strategy here…

CRA Advisory Services – Executive Consultation and Strategy

Are you clear on your CRA strategy and know how to leverage resources to maximize impact?

Work one-on-one with Linda Ezuka to co-create and strategize improvements to your CRA program. Sessions are tailored to your bank’s unique business context and based on your projected needs within your current exam cycle. Linda works with CEOs, Presidents, CRA Committee Leaderships and CRA Officers and CRA Teams.

Customized Commercial Loan Officer Training – Community Development Loans

Are your commercial loan officers regularly identifying CD loans?

This fast-paced and efficient training includes two foundational sessions customized to your bank. We will use your credit documents and a follow-up session to review pipelines and portfolios to undercover often missed loans. This training is tailored to busy loan officers, loan operations, and loan underwriting professionals.

Then our most dedicated CRA Officers choose to seek the CRA Certified Professional Designation

We are proud to announce that our industry finally has a professional designation for seasoned CRA professionals! Differentiate yourself from the competition. The CRA certification demonstrates your expertise in the regulatory compliance field with a CRA Certified Professional (CRACP) designation.

Trusted by Banks of All Sizes and Regulators

1,046 banks served

3,202 people served

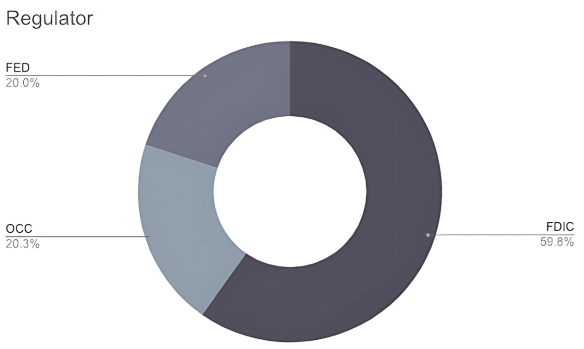

% of banks by regulator

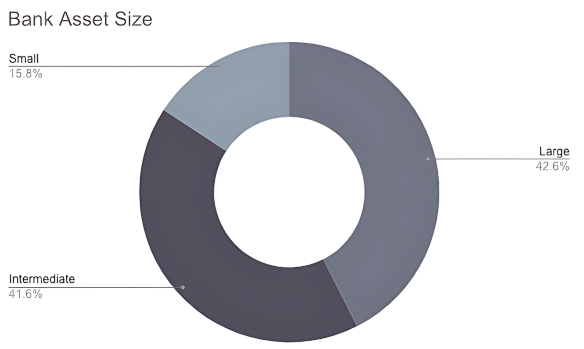

% of banks by asset size

More Training Opportunities

FREE CRA Essentials Live! Webinar

Would a live session at no cost help clarify our programs and solidify the value of our CRA training?

The CRA Essentials Live! Webinar is everything you need to create a solid foundation for your CRA journey. This is the perfect place to start for most professionals.

A Few Customers We’ve Proudly Served:

Community Development impact awaits; join your mission-driven peers on the list

Free Reference Guide

Regulatory Change Preparation Guide

After the Final Rule was released in October of 2023, we all seem to find

ourselves asking this same question, what now?

Compliance and CRA professionals tend to be balancing a lot of items on their plates and may not have the time they’d like to sit and review the final rule.

Navigating the new rule while finishing strong with the current rule can

seem daunting. This guide will help CRA Professionals as well as Chief Risk Officers in formulating a plan for regulatory change and provide the key risks to consider with questions to discuss with your team.