If you don’t have a large CRA team, haven’t had much training, or just inherited your bank’s CRA program, you’re probably feeling a little overwhelmed. It’s hard to run a CRA program during the best of times, but it may seem impossible during a pandemic. This is especially true if you don’t have a solid CRA foundation. And without a unified interagency approach to the CRA, this task is even more challenging.

Luckily, we have a few resources to help you get started.

Start with the history of the CRA

If you’re new to CRA, start by grounding yourself in the history. The CRA was one of many laws passed by Congress in the 1960s and 1970s intended to expand access to credit and combat redlining. This regulation is just as important now as when it was enacted in 1977.

Here are a few resources to get you started:

- The Community Reinvestment Act of 1977 | Federal Reserve History

- The Community Reinvestment Act’s History and Future (stlouisfed.org)

Understand the structure of the CRA

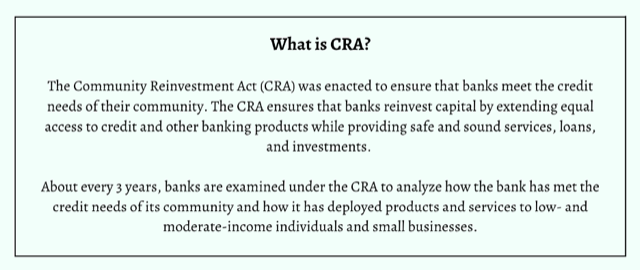

Once you understand the history of the CRA, you need to understand the structure and evaluative aspects of the regulation. A key part of the CRA is evaluating how a bank extends credit, offers services, and makes investments in the communities it serves.

Knowing what “counts” and how your bank will be evaluated is very important. Review your regulator’s guidance periodically to stay on top of any changes and updates. You can find each agency’s CRA regulation at:

- Federal Reserve Board (see 12 CFR 228)

- Federal Deposit Insurance Corporation (FDIC)

- Office of the Comptroller of the Currency (OCC)

Here are two quick reviews of the regulation and its provisions:

Learn more about the CRA and how to run a CRA program

There are lots of ways to learn more about the CRA.

You can attend events like the CRA & Fair Lending Colloquium, the bi-annual National Interagency Community Reinvestment Conference (March 2024), and regional regulatory roundtables. These are all great sources of information.

Here are a few other valuable resources:

- Federal Reserve Board – Community Reinvestment Act (CRA)

- FDIC’s Bank Finder (identify which regulator evaluates your bank’s CRA performance)

- CRA – Exam Schedule (see when you or your partner banks are being evaluated next)

- CRA Today offers a free Essentials Webinar available on-demand

- Bankrate’s article: “What is Redlining? A look at the history of racism in American real estate“

Reach out to other CRA officers

Running a CRA program may be difficult, but remember that you don’t have to do this alone. There are plenty of other CRA officers out there who are struggling, and there are plenty of experienced CRA officers who can help. Reach out to your peers, ask questions, and work together to figure out this incredible—but sometimes overwhelming—work.

You’ve got this!

CRA Today offers a wide variety of training and advisory services to help you master the CRA. Whether you are new(er) to the CRA or a seasoned professional, we stand ready to get your exam ready and help you drive impact into your local communities.

- Part of a Small CRA Team? Here’s How to Get the Help You Need - April 21, 2025

- Driving Impact and Building Trust: The Power of Collaboration Between Compliance Professionals and Lenders in Community Development Lending - August 1, 2023

- Finish Strong, as published in ABA Bank Compliance - December 31, 2022