Community development lending is a critical tool for driving impact and building stronger communities, but it requires a deep understanding of regulatory compliance and risk management. Compliance professionals and lenders are essential partners in this process, working together to identify hidden opportunities and navigate complex regulations and requirements. By building a culture of compliance and trust, compliance professionals and lenders can drive greater impact and help create a more equitable and sustainable future for all.

CRA officers are tasked with ensuring that the bank is meeting the credit needs of its communities and commercial lenders are front and center to that end. Commercial lenders are entrenched in local communities customizing financing options to help businesses manage cash flow and operational risk. When both compliance officers and commercial lender work together, community development impact is a natural outcome.

Community development lending and the CRA

Community development lending is an essential component of a bank’s Community Reinvestment Act (CRA) program, which aims to ensure that the bank is meeting the credit needs of its local communities, particularly those that are historically underserved.

The goal of community development lending is to improve the quality of life in these communities by creating jobs, stimulating economic activity, and promoting social equity.

Community development lending can take many forms, including loans for affordable housing projects, small business loans, and loans for community facilities like schools and healthcare centers. The focus is on projects that benefit low- and moderate-income communities, where access to traditional financing may be limited.

The Community Reinvestment Act defines a community development loan is defined (12 CFR 25.12(h)) as a loan that has as its primary purpose community development, and except in the case of a wholesale or limited purpose bank or savings association:

- Has not been reported or collected by the bank or savings association or an affiliate for consideration in the bank’s or savings association’s assessment as a home mortgage, small business, small farm, or consumer loan, unless the loan is for a multifamily dwelling (as defined in § 1003.2(n) of this title); and

- Benefits the bank’s or savings association’s assessment area(s) or a broader statewide or regional area(s) that includes the bank’s or savings association’s assessment area(s).

Community development is defined as (12 CFR 25.12(g)):

- Affordable housing (including multifamily rental housing) for low- or moderate-income individuals;

- Community services targeted to low- or moderate-income individuals;

- Activities that promote economic development by financing businesses or farms that meet the size eligibility standards of the Small Business Administration’s Development Company or Small Business Investment Company programs (13 CFR 121.301) or have gross annual revenues of $1 million or less; or

- Activities that revitalize or stabilize—

- Low-or moderate-income geographies;

- Designated disaster areas; or

- Distressed or underserved nonmetropolitan middle-income geographies

The Pain Points

While the definition of community development and community development loans seems straight forward enough, the challenge is honing in on the primary purpose of the loan and following the flow of capital to actual community development impact as defined by the CRA provisions.

First of all, most commercial lenders haven’t been adequately trained on how to identify community development loans through their normal course of business. Given the subjective nature of community development loan compliance, training needs to be conducted on a regular basis and with special emphasis on the subtle nuances that are required to pass regulatory scrutiny. For example, it is not enough to merely identify a loan that was originated in a low- or moderate-income census tract, lenders would need to also consider the actual impact on the geography (§ ll.12(g)(4)(ii)—2). Impact, as it relates to revitalize and stabilize a low- or moderate-income community, is typically considered if the loan purpose helps attract new or retain existing businesses in a community that employ local residents, including low- and moderate-income individuals.

A second challenge is there is no unique identifier, loan or call code that would automatically identify a loan as a qualified community development loan given the subjectivity of the determining a “primary purpose” and the requirements to fit into one for the standard definitions of community development. This limitation requires that either a commercial lender, a loan underwriter, a loan documentation specialist or a compliance professional review all prospective loans for a primary purpose of community development by following the loan proceeds to the intended impact. Without a human intervention, there is no systemic way to identify community development loans with absolute certainty.

The third complexity of identifying community developments loans is the common practice and necessity of data mining by under resourced compliance officers. Short of lenders identifying community development loans upon origination, compliance professionals are often left to review hundreds and thousands of loans sometimes months after the fact. This process involves pulling credit memos, reviewing loan purposes and sources and uses of funds and comparing various aspects of the loan with common regulatory resources that have been deemed to be acceptable proxies and benchmarks to prove that the loan meets the “primary purpose” of community development.

For example, “primary purpose” can be defined generally in one of four ways per the Interagency Questions and Answers Regarding Community Reinvestment Guidance (§ ll.12(h)—8). The first approach is if a majority of the dollars or beneficiaries of the loan are identifiable to one or more of the enumerated community development purposes, then the activity will be considered to possess the requisite primary purpose. Alternatively, primary purpose will be defined as either:

- The express, bona fide intent of the loan is primarily one or more of the community development purposes, or

- The loan is specifically structured to achieve the expressed community development purpose; or

- The activity accomplishes, or is reasonably certain to accomplish, the community development purpose involved.

The last bullet is the most subjective element of identifying community development loans and is the provision that cements the subjectivity of the CD loan identification process.

The Opportunity

To support community development lending efforts, compliance professionals must work closely with lenders to navigate complex regulatory requirements while managing risk appropriately. This involves a variety of approaches to build a culture of compliance and trust within the bank by providing training and support to lenders and other staff members involved in community development lending.

Training is an often-overlooked aspect of a CRA program as many banks simply deploy compliance training via standard, non-customized regulatory compliance training as part of their annual compliance suite of online training modules. Compliance officers should refresh their approach to offer customized training per business unit and offer continuous feedback and micro-training moments throughout the year. For example, after a periodic review of potential community development loans has been conducted (monthly or quarterly is recommended), a compliance officer could compile the list of recently identified community development loans and send a congratulatory email to the lending division with a copy to executive management. The memo can highlight a certain loan officers’ efforts or spotlight a highly impactful community development loan project to reinforce their role in the bank’s CRA program and impact in local communities.

At the heart of any CRA program is an active compliance officer both running the internal compliance aspects of a CRA program while leading externally out in the community by participating in community-based meetings with nonprofits, local governmental entities, and philanthropic entities. Through this work, compliance professionals form deep relationships with various stakeholders that care deeply about their local communities and potential loan opportunities naturally result through community development convening. This is where compliance professionals in turn support business development by bringing and loan deals to the bank for consideration.

When lenders see the compliance professional as a partner to enhancing their loan pipeline, trust and collaboration start to build.

Collaborating To Drive Greater Impact

As CRA programs mature within banks and compliance officers have established strong relationships with lending units, more collaborative opportunities then emerge to drive even greater impact and build stronger communities.

The end goal of community development lending is to improve the quality of life in these communities by creating jobs, stimulating economic activity, and promoting social equity.

Community development lending can take many forms, including loans for affordable housing projects, small business loans, and loans for community facilities like schools and healthcare centers. The focus is on projects that benefit low- and moderate-income communities, where access to traditional financing may be limited.

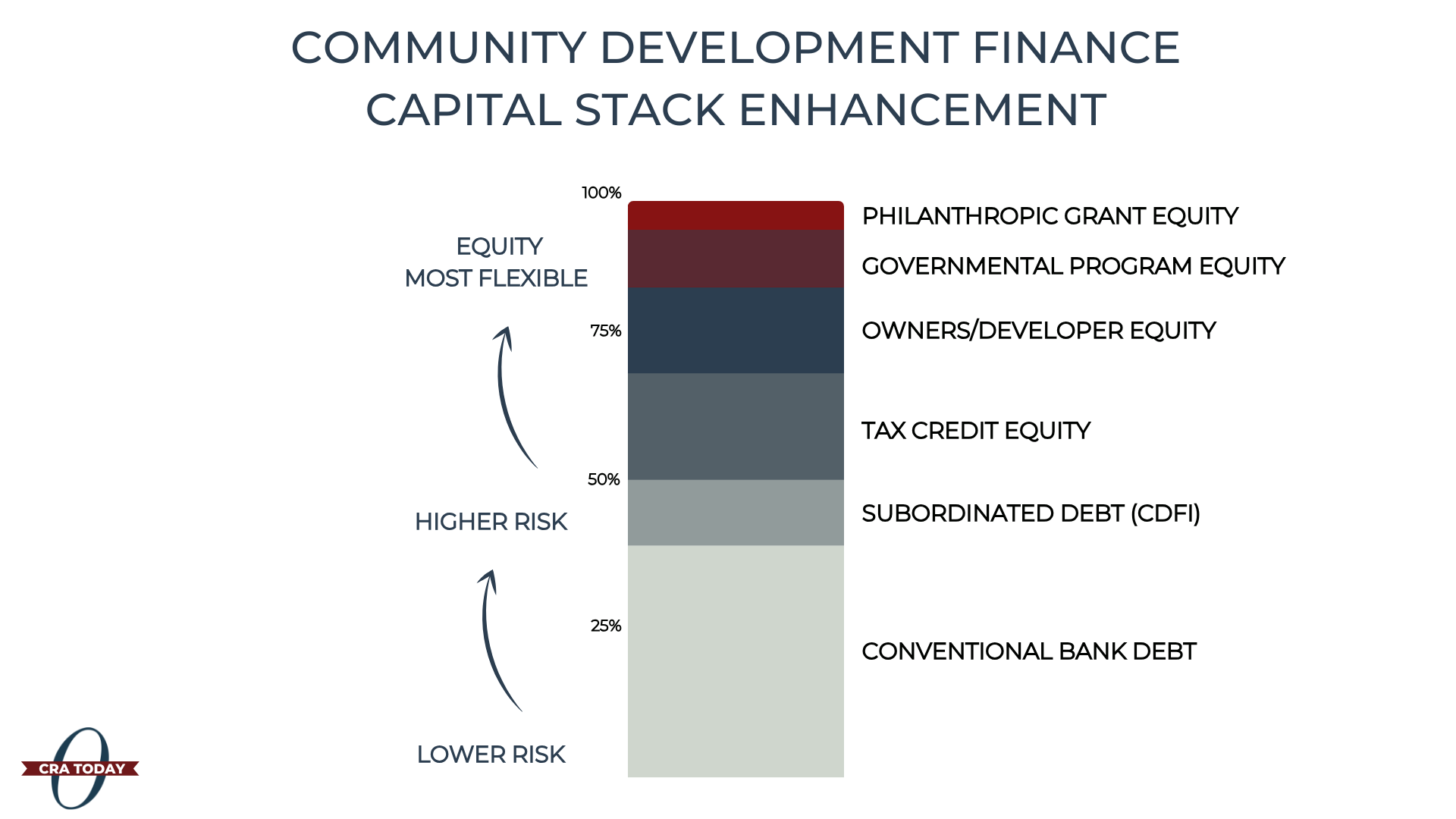

Compliance officers are involved in community-based initiatives and are in front of many community-based projects. Often these officers bring potential loan transactions to the bank for consideration. Not only do they bring potential community development loan deals to the bank, they also bring local partners to the table that can enhance the capital stack and reduce risk to the bank. The value of bringing equity and partners to enhance the capital stack to make undoable deals, doable and to drive opportunity in under resources and disadvantaged communities.

A capital stack is the funding or investment structure of a project, layered with various sources of capital. In this model, the sources of capital are stacked on top of each other to enhance community development financing projects. Banks typically are at the base of any funding project with traditional/conventional debt and sources are layered on top of bank financing with those investors willing to take the most risk at the top of the stack. A capital stack for a community development project might be made up of a combination of equity (such as grant funds from private or government sources), Community Development Financial Institution (CDFI)-flexible debt, and conventional debt. All these layers together make a community development loan possible and often times the more impact in a project, the more layers are required to drive impact into the most disadvantaged communities.

Community development loan opportunities either come from compliance officer referrals or organically as loan prospects, lenders with a strong understanding of the CRA with a solid relationship with compliance officers are best positioned to leverage resources.

A few examples of loan enhancements are:

- Loan Guarantees and Grants from Philanthropic Entities

- Local, State and/or Federal Governmental Grants

- Community Development Financial Institution (CDFI) Loan Participation

In the end, the stronger the relationship between lenders and the compliance officer, the more likely creative solutions emerge from deep local relationships to increase impact in under resourced and disadvantaged communities.

A Path Forward for Compliance Professionals

Compliance professionals play a critical role in driving impact and building trust through collaboration with lenders in community development lending. As community development lending continues to evolve, compliance professionals must be willing to adapt and respond to the changing landscape while still maintaining a culture of compliance and trust.

One key aspect of this adaptation is the need for customized and ongoing training for lenders and other staff members involved in community development lending. Compliance officers should take the lead in providing this training and offering continuous feedback and micro-training moments throughout the year. By doing so, compliance officers can reinforce the importance of community development lending and the bank’s commitment to meeting the credit needs of its local communities.

In addition to training, compliance officers must also actively engage in community-based initiatives and form deep relationships with various stakeholders that care about their local communities. This involvement not only helps compliance officers identify potential loan transactions for the bank, but also allows them to bring local partners to the table that can enhance the capital stack and reduce risk to the bank. When resources are leveraged, undoable deals are then doable by “de-risking” complicated loan transactions and driving impact for the greater good.

Collaboration between compliance professionals and lenders can drive even greater impact in community development lending by leveraging resources and finding creative solutions to increase impact in under-resourced and disadvantaged communities. As compliance officers continue to play an increasingly important role in community development lending, they must be willing to adapt and collaborate in order to drive greater impact and help create a more equitable and sustainable future for all.

- Part of a Small CRA Team? Here’s How to Get the Help You Need - April 21, 2025

- Driving Impact and Building Trust: The Power of Collaboration Between Compliance Professionals and Lenders in Community Development Lending - August 1, 2023

- Finish Strong, as published in ABA Bank Compliance - December 31, 2022