Are you exam ready?

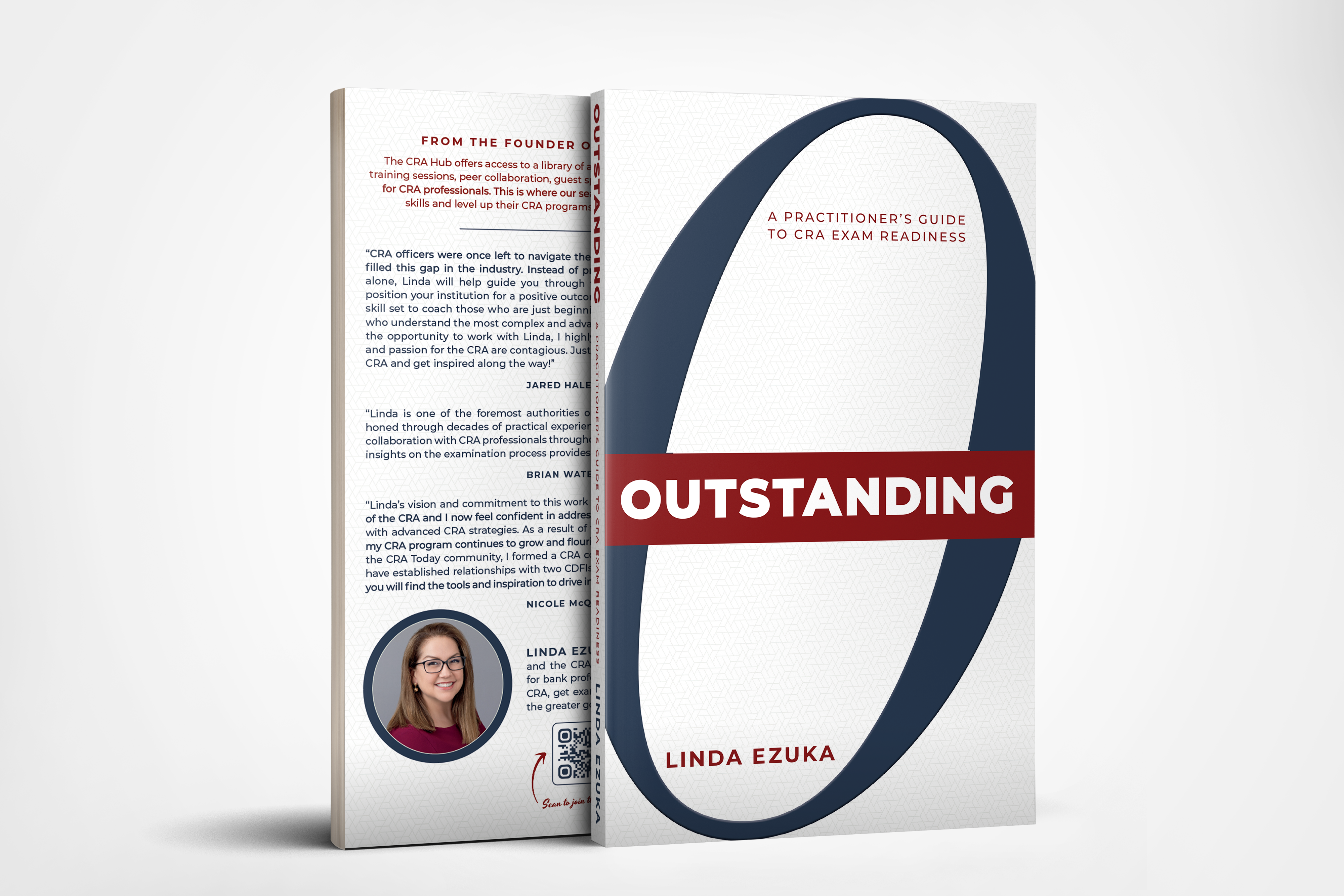

Outstanding: A Practitioners Guide to CRA Exam Readiness

is now ready to order!

“Let’s never forget the power of a dollar matched with a vision and relentless grit.” ~ Linda Ezuka

About the Book

Outstanding: A Practitioners Guide to CRA Exam Readiness

The CRA is the most subjective and often misunderstood consumer compliance regulation.

In Outstanding, Linda Ezuka demystifies preparation and readiness for the CRA examination process, using industry best practices and a little bit of regulatory pixie dust.

Outstanding is about more than just CRA readiness.

You will also discover…

- How to master the art of CRA program management even if this is your first exam or you’re just starting out

- The #1 tool for CRA exam prep!

- The 3 most important foundational elements to build a successful CRA program

- The simple strategies that will help you reach CRA target goals, identify program gaps, and remediate your bank’s deficiencies.

- How to get executive management buy-in to build a compliance culture with leadership from the top

- Why you should never exclude internal stakeholders from your bank’s CRA exam preparation

- The TRUTH about curating your impact story to ensure a solid CRA exam result

- Where to find CRA-specific software solutions to help you efficiently collect, monitor, and report your CRA-specific data

- How to leverage the CIDR as the ultimate roadmap to exam prep

- The winning approach to issue management

- What to do if you need to defend your CRA performance

- Curated tips from top CRA practitioners in the field

- And MORE!

What Others Are Saying

“CRA officers were once left to navigate the CRA on their own, but Linda has filled this gap in the industry. Instead of preparing for your next CRA exam alone, Linda will help guide you through the CRA’s subjective nature and position your institution for a positive outcome.”

JARED HALES, CEO, Kadince

“Linda is one of the foremost authorities on CRA. Her knowledge has been honed through decades of practical experience working in banks and through collaboration with CRA professionals throughout the nation. Her perspective and insights on the examination process provides untold value to banks of all sizes.”

BRIAN WATERS, President, COO & Co-Founder, findCRA

“Linda’s vision and commitment to this work has ramped up my understanding of the CRA and I now feel confident in addressing my executive team and board with advanced CRA strategies. As a result of this higher level of understanding, my CRA program continues to grow and flourish. Since joining the CRA HUB and the CRA Today community, I formed a CRA committee, drafted a CRA plan, and have established relationships with two CDFIs and one MDI. CRA Today is where you will find the tools and inspiration to drive impact into your local communities.”

NICOLE McQUARRIE, CRA Officer, Plumas Bank

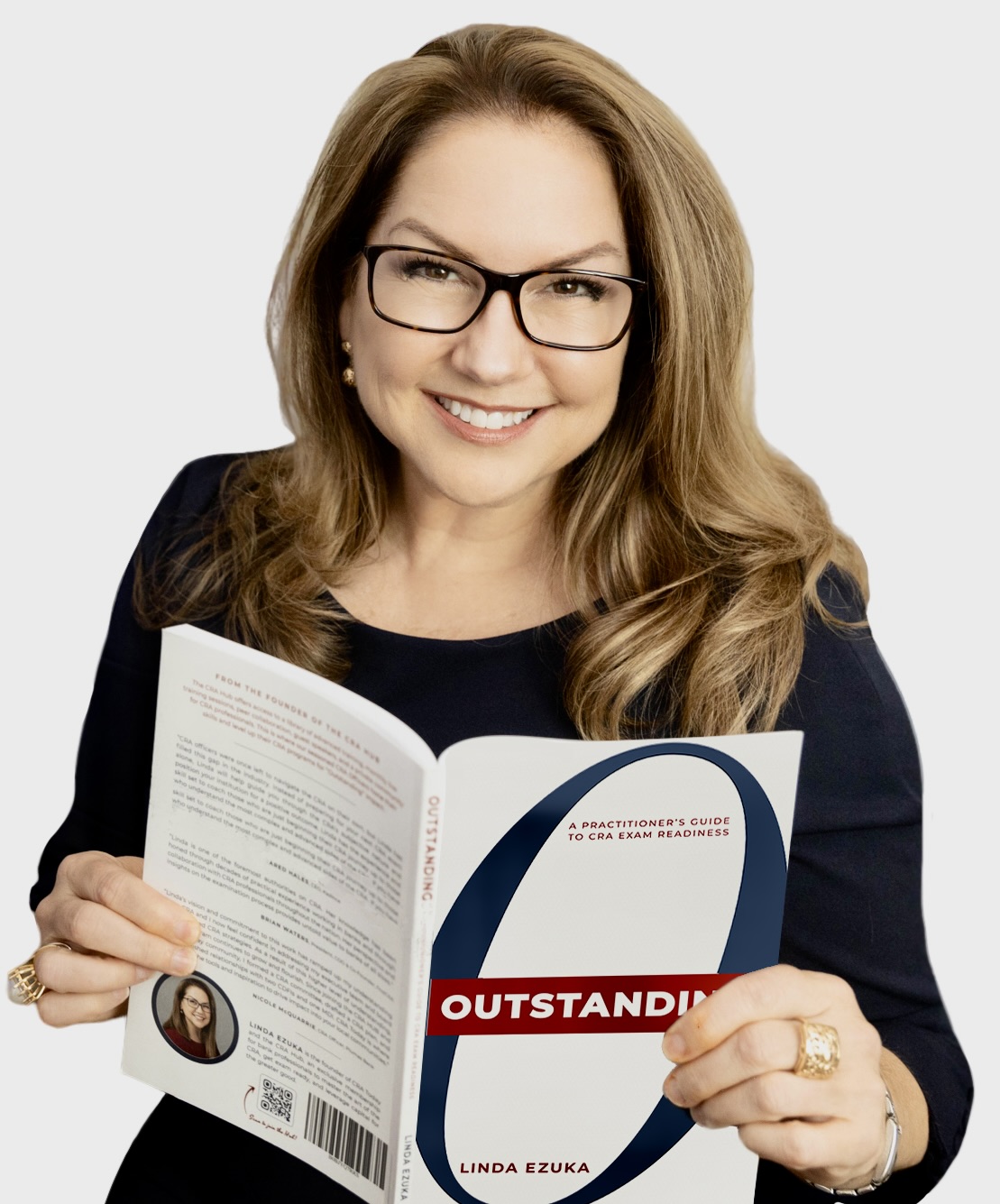

About the Author

Linda Lewis Ezuka is the Founder of CRA Today and the CRA Hub, an exclusive membership for bank professionals to master the art of the CRA and transform communities through economic development.

Linda also hosts the CRA Podcast, a podcast to elevate conversations around the Community Reinvestment Act.

Ms. Ezuka has over 30 years of community development experience, with emphasis on:

- CRA compliance

- CRA on-site and remote training

- Community development finance

- CDFI initiatives

She has led CRA programs for large banks and has consulted with banks of all sizes and regulators.

Ms. Ezuka currently serves on:

- The Board and Investment Committee of the HMSA Foundation

- The Advisory Board of the Patsy T. Mink Center for Business & Leadership.

She was previously Chairwoman for the Board for the YWCA of Oahu, Hospice Hawaii and HCRC. She has also served on various nonprofit boards, focusing her leadership efforts on serving CDFls and disadvantaged communities.

She is a CDFI NMTC and CDFI Reader, a Pacific Century Fellow, an SBA Financial Services Advocate of the Year Awardee, and a Pacific Business News 40 Under 40 Honoree.

Trusted by Banks of All Sizes and Regulators

1,046 banks served

3,202 people served

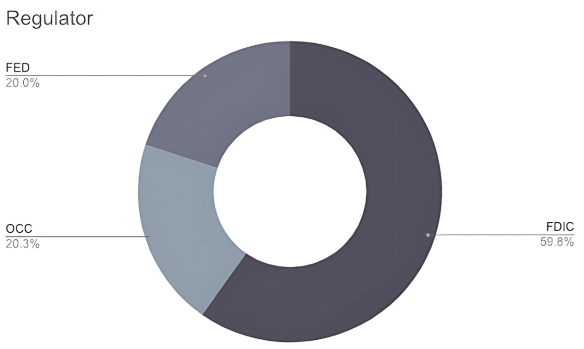

% of banks by regulator

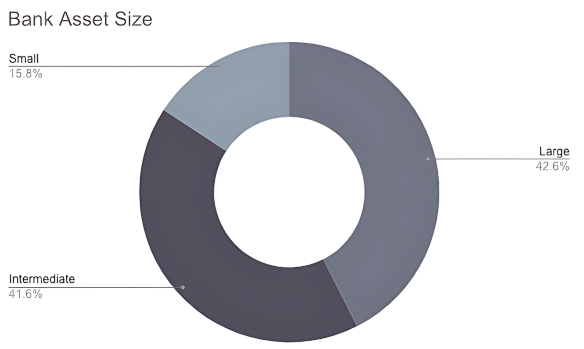

% of banks by asset size

The worklife of a CRA professional has two seasons …

… you are either preparing for an exam or recovering from one!

Here you will find a bundle of resources crafted to support your exam prep efforts and outcomes, tailored for preparing for an exam in the next 12 months. These resources will demystify preparation for your upcoming CRA examination, using industry best practices and a little bit of regulatory pixie dust.