Are You Ready To Confidently Lead Your Bank’s Program As The CRA Expert?

Even during the chaos of regulatory reform?

Join the waitlist and be the first to know when we open registration for our next 10-week CRA Fundamentals cohort.

CRA Fundamentals Course & Certification

You don’t have to go it alone…

If you’re new to the CRA, have been running a program without any formal training, or wonder if you have some gaps in your understanding, it’s time to consider the CRA Fundamentals course!

I show CRA professionals like yourself how to level up their programs and maximize their loan performance.

You know there aren’t enough CRA training opportunities in our industry. You also know that there are too many subjective elements of the CRA to second guess yourself as the weight of your upcoming CRA exam looms. I carefully created this course to deliver clarity and provide a community of peers to lean on so no one feels like they are alone in this work ever again.

Ten weeks to CRA program certainty…

From beginning to end, all core aspects of the CRA are shared. Each module will guide you to implement within your bank and homework is assigned to ensure you can be sure your bank is compliant. This means no more wondering if your data has integrity, or how to prep for your next exam, and everything in between.

Module 1

CRA Regulatory Context and Key Definitions

Module 2

CRA Assessment Areas

Module 3

Community Development Services

Module 4

Lending Performance

Module 5

CRA Data Collection, Integrity and Reporting

Module 6

Community Development Loans

Module 7

Community Development Investments

Module 8

CRA Technical Compliance Requirements

Module 9

CRA Self Assessment

Module 10

CRA Exam Management

Bonus 1

CRA Public File Checklist

Bonus 2

CRA Data Integrity Root Cause Analysis Template

Bonus 3

CRA Loan Data Collection and Reporting Grid

Bonus 4

Ask Me Anything Office Session

What you get with the CRA Fundamentals Course

The CRA Fundamentals course includes 10 weeks of LIVE training with Linda Ezuka. That’s over 20 hours of training delivered in bite-size pieces on a weekly basis so you can balance your current priorities.

Also included in the training is a CRA Fundamentals manual that you can download, 20 ABA CRCM credits, one year of access to the training replays and resources, a community platform to connect with your CRA peers, and a few more surprises along the way!

We also have bonus materials to make sure your CRA program is compliant. From ensuring your public file is accurate, to ensuring your loans are categorized correctly (and accurately), all materials and the bonuses are curated with the CRA professional in mind!

Bonus

CRA Public File Checklist

Bonus

CRA Data Integrity Root Cause Analysis Template

Bonus

Bonus

Ask Me Anything Office Session

100% Satisfaction Guarantee!

We are here to serve!

If this course does not meet your expectations, a full refund will be issued without any questions asked. You will have access to two live training sessions to make sure the course is what you were expecting and adds value to you and your bank’s CRA program.

Our most dedicated CRA Officers choose to seek the CRA Certified Professional Designation

The CRA Fundamentals course is one of the core requirements to seek the CRA Certified Professional (CRACP) designation. This new CRA certification is the first and only designation available to CRA professionals.

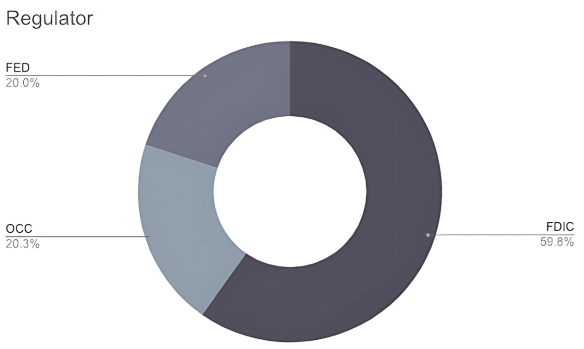

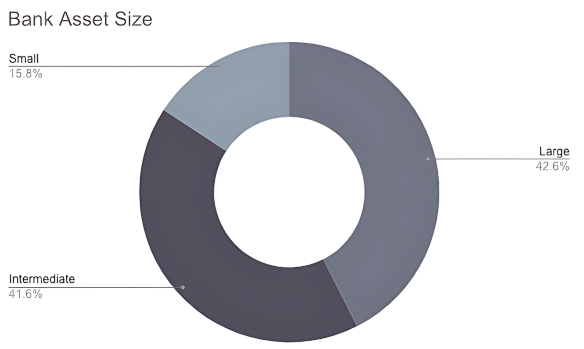

Trusted by Banks of All Sizes and Regulators

1,046 banks served

3,202 people served

% of banks by regulator

% of banks by asset size

Frequently Asked Questions

Here’s what people are asking before signing up for the CRA Fundamentals Course!

How long will I have access to course materials?

After purchasing the CRA Fundamentals course, you will have access to course materials and resources for 12 months from the date of purchase.

Should I wait to purchase the course until the injunction is lifted?

How can I pay for the CRA Fundamentals course?

You can process via credit card, ACH or via check/invoice. Reach out to us at linda@cratoday.com to arrange for an invoice or an ACH transaction.

Will there be a certification option after the course?

Yes. Once you complete the CRA Fundamentals course, you will be eligible to take the CRA Certification Exam. Learn more.

Does the CRA Certification Exam cost extra?

The cost for the CRA Certification Exam is $395 and retakes are $100. Learn more.

Will Continuing Professional Education (CPE) credits be required once I get certified?

CPE credits require 10 credits per year for a total of 30 per three-year recertification period. Learn more.

You asked for it!

Join the waitlist now and line up your budget approvals in advance.

Most bundle the course and membership so you will be set up for success during regulatory change!

The CRA Fundamentals Course:

Learn the core provisions of the law, the definitions, technical compliance, data integrity, performance analytics, how to conduct a self assessment, how to prep for your next exam and more.

This course sets the foundation of knowledge of the law, so you can ensure your bank is exam ready and navigate regulatory changes with confidence and clarity.

Consider this course the educational equivalent to a semester long advanced college course, and yes, with homework.

*We are happy to invoice your bank or set up an ACH relationship. Please email linda@cratoday.com to request an invoice.

Fundamentals Course: $2,750 (one-time fee)

Bundle to save and get support year round:

Bundle CRA Fundamentals Course + CRA Hub Membership

Now, if you join the CRA Hub, you get a special rate for the CRA Fundamentals course.

Once you have a solid foundation from the CRA Fundamentals course, a community of peers will be waiting for you within the CRA Hub to help you implement, all year long!

The CRA Hub is where you take action and apply your CRA knowledge to level up your bank’s CRA program.

CRA professionals convene and share best practices around maintaining exam readiness, building a compliance culture within the bank, implementing special purpose loan programs, forging partnerships with CDFIs, avoiding underreporting community development activities, and more!

Oh, and did I mention, the CRA Hub is where we will unpack the new CRA regulation once promulgated and within the short implementation period. You absolutely don’t want to go at it alone as this rule will be like no other-the bar has been raised!

The CRA Hub offers continuous access to our library of advanced training, monthly live training sessions, peer collaboration, guest speakers, and a private community for CRA professionals.

Fundamentals Course: $2,250 ($2,750) + CRA Hub Membership: $3,250 = Bundle Price: $5,500** ($500 savings)

*Includes enrollment in the 10 week CRA Fundamentals course and one year membership with the CRA Hub (you will be invoiced annually, cancel anytime)

**Your CRA Hub membership will start two months after the start of the Fundamentals so you can stay focused on the Fundamentals before you join the larger community of peers in the Hub.

***We are happy to invoice your bank or set up an ACH relationship. Please email linda@cratoday.com to request an invoice.

“The CRA Fundamentals Course has helped me to become more confident as a CRA Officer. It’s helped me fill in my knowledge gaps as I navigate the expanded CRA requirements at a large bank from those at my previous small bank. I love that I can go back to the lessons to re-watch as needed for further reinforcement. The community of fellow CRA professionals in our cohort was wonderful too. The variety of bank sizes, regulators and experiences represented in our group added depth to our discussions and hearing real-world examples and questions brought the material to life. Finally, Linda’s passion and commitment to helping us all serve our local communities and carry out this important work is infectious. Her expertise paired with her warm, upbeat personality make her the perfect teacher.”

Kerry D., CRA Officer, FDIC, Large Bank

The worklife of a CRA professional has two seasons …

… you are either preparing for an exam or recovering from one!

Here you will find a bundle of resources crafted to support your exam prep efforts and outcomes, tailored for preparing for an exam in the next 12 months. These resources will demystify preparation for your upcoming CRA examination, using industry best practices and a little bit of regulatory pixie dust.